-

Ursa Minor

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Ursa Minor

Published: 10-02-2015The bears are stirring. Not yet rampaging, but there’s a lot of red ink across most markets.

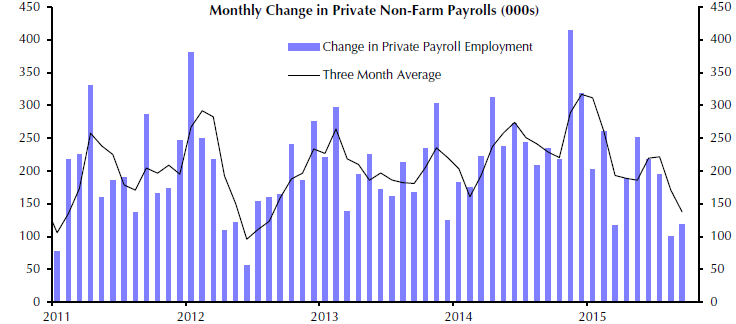

Today’s jobs report was weak. No honey-coating it, it was a treat for the bears. Payrolls rose 142,000, well below the 200,000 expected, and a jump in government jobs hid a weaker private sector rise of 118,000. July and August were revised lower, so the employment picture weakened substantially in the 3rd quarter.

The unemployment rate remained at 5.1%, only because there was a huge (350,000) reduction in the labor force, bringing the labor participation rate to 62.4%, the lowest since 1977. About the only bright spot in the release was the broader U-6 data, which include both un- and under-employed: that rate fell to 10.0% from 10.3%, the lowest yet in this recovery.

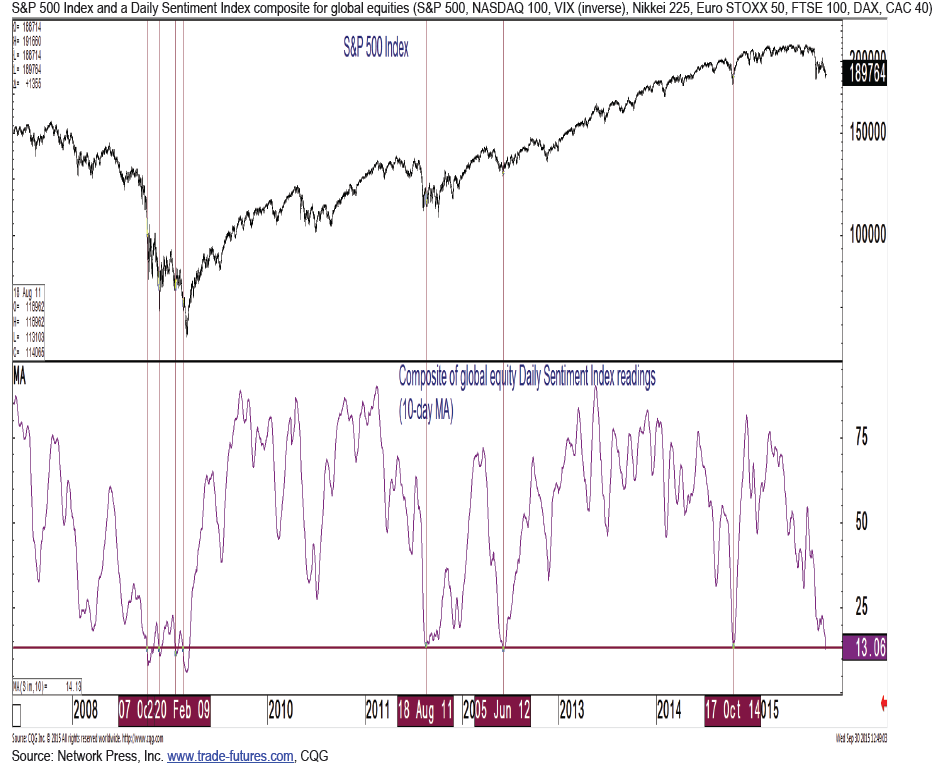

With red ink spilling across global markets, sentiment has become pretty gloomy (see below).

The good news, from my perspective, is that sentiment is one of my favorite contrary indicators. Indeed, note in the chart above the coincidence of bearishness with market bottoms.

So, yes, the economy is softening in some areas—manufacturing, jobs—although resilient in other areas: auto production is soaring, housing prices and incomes are rising. A recession in the next 12 months seems very unlikely to me, although today’s data may spook members of the Fed to push out the date of their (modest) tightening. The markets now see March 2016 as most likely.

I continue to hold the view that US equities are in the midst of a multi-year bull market, where corrections, dips and gyrations should be expected. This is now a non-consensus view among the growing sleuth of bears which, as you might guess, I find encouraging.

Print this ArticleRelated Articles

-

![Wild, Wild East]() 13 Jul, 2015

13 Jul, 2015Wild, Wild East

The central planners in Beijing have gotten so much right for the past three decades, that they might be forgiven for ...

-

![Selected Fun Facts]() 14 Nov, 2014

14 Nov, 2014Selected Fun Facts

Some fun facts about this year (courtesy Michael Hartnett of Merrill Lynch):US equities (+14%) are ahead of European ...

-

![Dollar]() 6 Feb, 2015

6 Feb, 2015Dollar

My quarterly letter talks about the strength of the US dollar and why it should continue to rise (see Chart below), but ...

-