-

Floating Oil

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Floating Oil

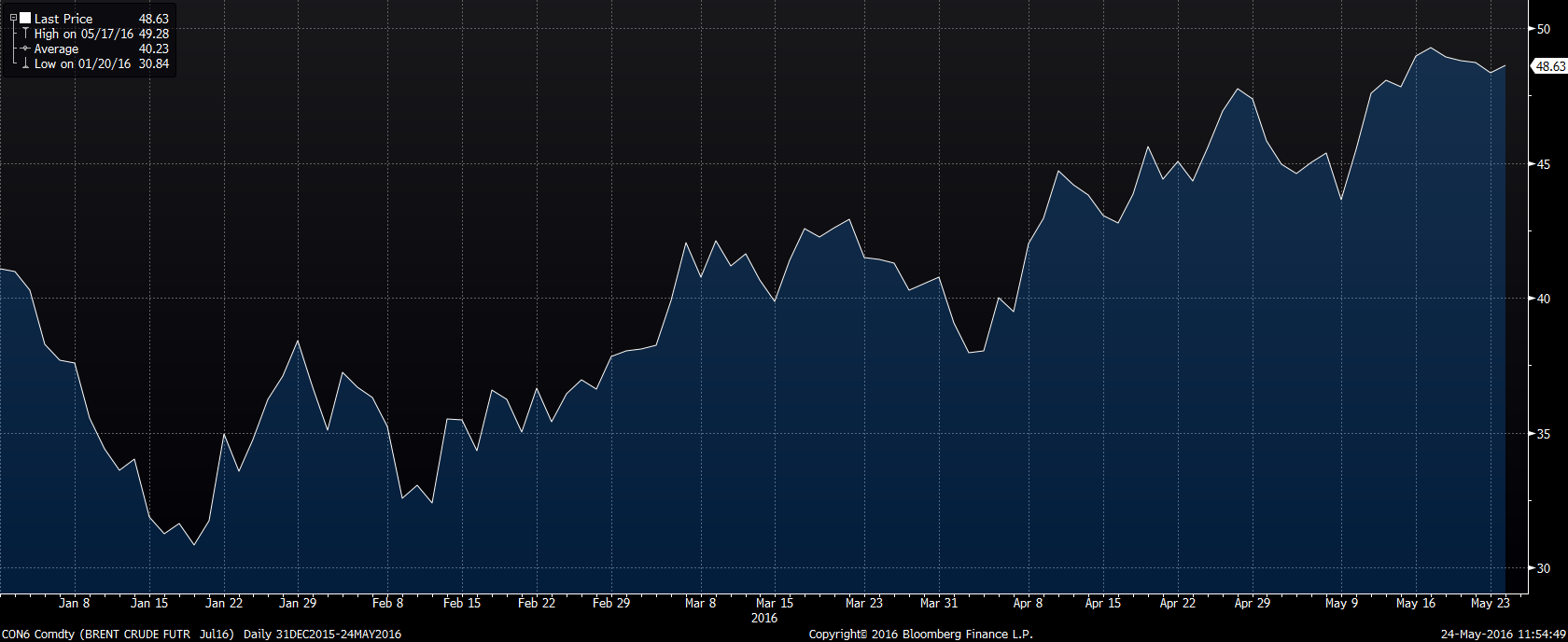

Published: 05-24-2016Oil has had a nice recovery this year (see graph for Brent, YTD), up about 18% to over $48/barrel today. Of course, this is still well below the +$100/barrel we saw from 2011 through most of 2014, so will oil continue its climb higher?

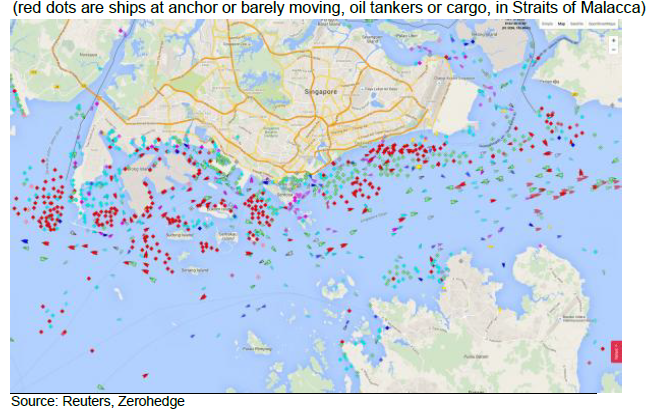

Um….no. I don’t see any oil tankers in Santa Monica Bay today, but if I looked out my window in Singapore, it would be a very different story. Through the Straits of Malacca, between Malaysia and Indonesia, one of the most strategically important shipping lanes in the world, flows more than 15 million barrels of oil every day, about 27% of the entire world oil maritime trade. Today, there are 40 supertankers anchored offshore Singapore (see map below), each holding more than one million barrels of oil. The Straits are more congested than the 405 at 5pm.

A few months ago, traders earned a positive arbitrage by storing oil in these tankers and selling later as the price jumped. But today that arbitrage is negative, anywhere from $0.48 per barrel for 30 days to more than $6 per barrel for 12 months. So this oil is not being stored for profit: we’ve run out of places to hold it.

The more oil that floats, the more the price will sink.

Print this ArticleRelated Articles

-

![It's About Time]() 22 Sep, 2017

22 Sep, 2017It's About Time

Lost Time is never found again, advised Benjamin Franklin in Poor Richards Almanack. And Dante Alighieri observed, The ...

-

![Wild, Wild East]() 13 Jul, 2015

13 Jul, 2015Wild, Wild East

The central planners in Beijing have gotten so much right for the past three decades, that they might be forgiven for ...

-

![Housing Has Legs]() 24 May, 2016

24 May, 2016Housing Has Legs

Surprisingly strong housing numbers out this morning: new single-family homes rose 16.6% in April to an annual pace of ...

-