-

Puerto Pobre

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Puerto Pobre

Published: 06-30-2015An honest politician may be oxymoronic (or is just moronic?), or maybe it’s the black swan that surprises us when seen. Either way, Alejandro Garcia Padilla, governor of the US Commonwealth of Puerto Rico, stated in clear terms a 5-year old could understand (which thus qualifies it as a black swan of political clarity) that Puerto Rico cannot pay its debts; period.

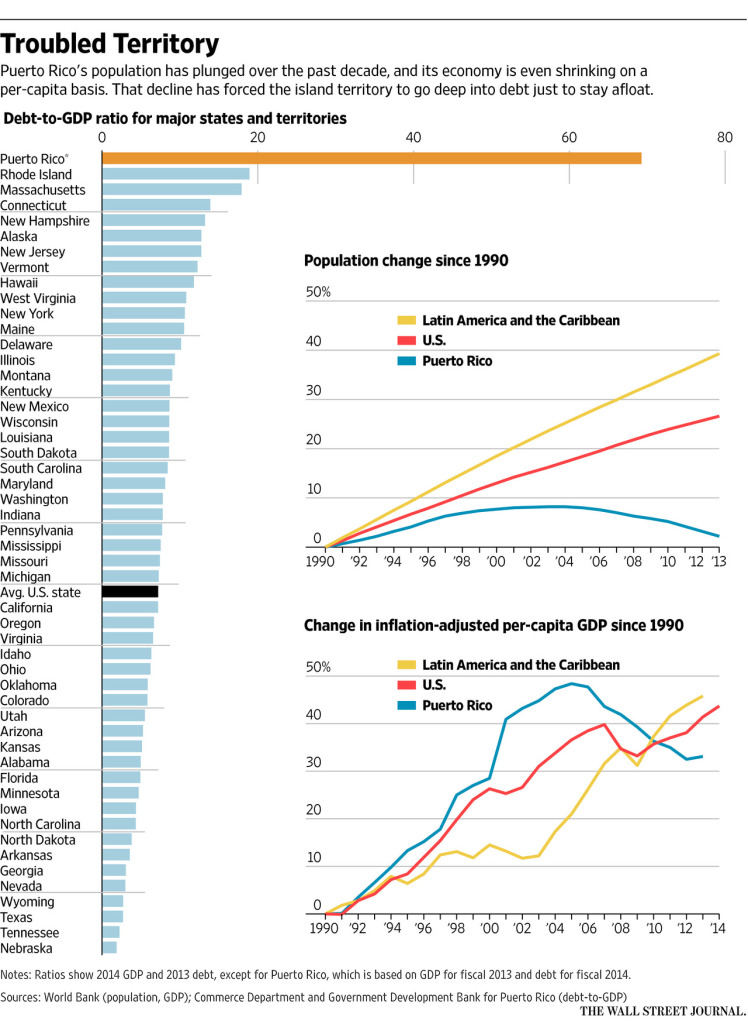

This island of 3.5 million very nice people, with a GDP less than Sacramento, has amassed debts of $72 billion. As is so often (always?) the case, excessive debt is not the disease, it is a symptom of the disease. In Puerto Rico’s case, its GDP has been falling for a decade, only 40% of the working-age population works, and people are fleeing the island for the US mainland. Obviously, these three developments are all linked (see Graph below).

A decade ago (2002), Congress removed the generous tax breaks for companies doing business in Puerto Rico, and businesses pulled out, proving that there was no reason to be in Puerto Rico (cheap labor, productive workers, low taxes and regulations) but for the US federal tax exemption. Forced to compete, Puerto Rico couldn’t, or rather, didn’t. Instead, successive governors continued to grow the size of government. The most recent smart idea from Mr. Garcia Padilla is to raise the sales tax from 7% to 11.5%.

I don’t know why I am continually astonished with the absence of economic sense among politicians and pundits. I’m just politically naive, I suppose. Pro-market reforms—limited taxes and regulations, labor flexibility, etc.—lead to economic growth and prosperity wherever they have been adopted (much of Asia as exemplar primus). The opposite policies lead to stagnation and poverty. This is not theory, just empirical fact.

A restructuring of Puerto Rico’s debt is inevitable, as it is with Greece and others (Venezuela comes to mind). But absent pro-market reforms, no amount of debt restructuring (default/forgiveness/reduction) will avoid a repeat of this cycle. Delay, yes; avoid, no.

Print this ArticleRelated Articles

-

![Humans! What Are They Good For?]() 29 Jun, 2017

29 Jun, 2017Humans! What Are They Good For?

It looks like the world is turning against humans. Ive talked before about the rise of robots in manufacturing (2016 ...

-

![Fireside Reading]() 21 Dec, 2023

21 Dec, 2023Fireside Reading

I hope you have a wonderful holiday season, with ample time to enjoy some good books next to a crackling fire. I have an ...

-

![Beach Reading]() 19 Jul, 2022

19 Jul, 2022Beach Reading

It is definitely beach weather, and I have a dozen recommendations for you. Happy reading! FictionDay for Night, ...

-