-

Reversal

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Reversal

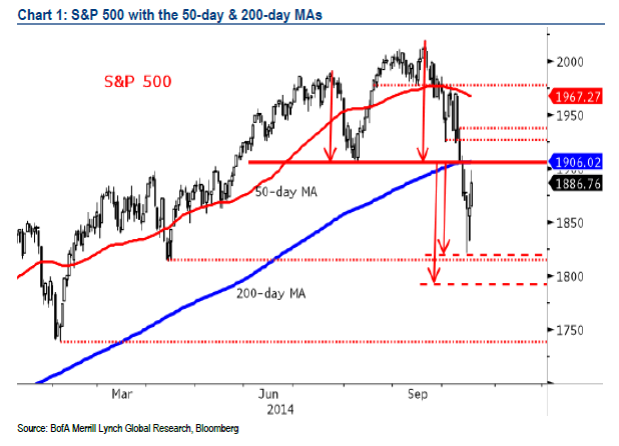

Published: 10-21-2014I’m interpreting the spike down last week and the strong rebound in the past few days as bullish. See the chart below from Friday’s close (courtesy of our friends at Merrill).

We have held our positions in our model portfolios, neither panicking during the deluge nor trying to catch the bottom of this short-term move. Remember that much of what happens hour-to-hour, day-to-day, week-to-week, even year-to-year, has (or should have) little practical impact on long-term investors. Let’s make sure we have the cash to pay the bills and cover reasonable contingencies; after that, we can be largely indifferent to the spasms of the markets.

Print this Article

Related Articles

-

![Still Beach Reading]() 10 Sep, 2020

10 Sep, 2020Still Beach Reading

It's still beach weather here in Southern California, so I have a few more suggestions for beach reading.Begin Again by ...

-

![Beach Reading]() 13 Aug, 2024

13 Aug, 2024Beach Reading

Six new books for you, all fiction, all great. I hope you enjoy!The Sellout, Paul BeattyThis is possibly the most ...

-

![A Year-End Thought]() 31 Dec, 2015

31 Dec, 2015A Year-End Thought

This week, my college basketball team visited southern California, and I was lucky enough to spend some time with them ...

-