-

Inversion

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Inversion

Published: 04-12-2019

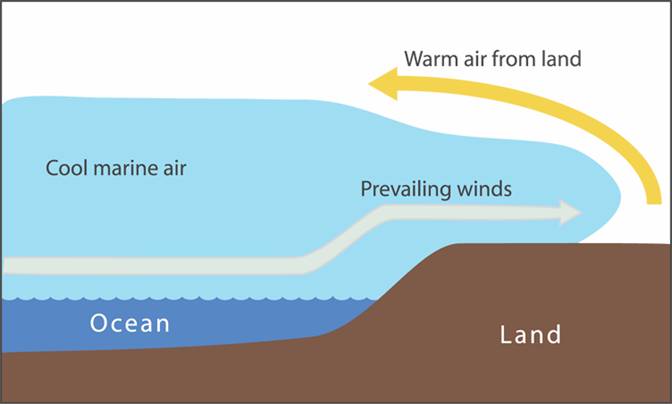

Say “inversion” to a Californian, and the most likely word association is “layer.” It’s our topography that causes this phenomenon, accounting for the haze, smog and “June Gloom” we experience. It’s not a modern phenomenon either: Juan Rodriguez Cabrillo called it Baya de los Fumos, from the dozens of native Tongva campfires that filled the air when he sailed into Santa Monica Bay in 1542.

Normally, air temperature drops with altitude. But in Southern California in the spring and summer, the colder marine air comes ashore to meet the warmer air on land that rises above the ocean air, which then traps emissions, resulting in haze and smog (which is its own made-up word combining smoke and fog).

Source for image above: https://commons.wikimedia.org/w/index.php?curid=318568

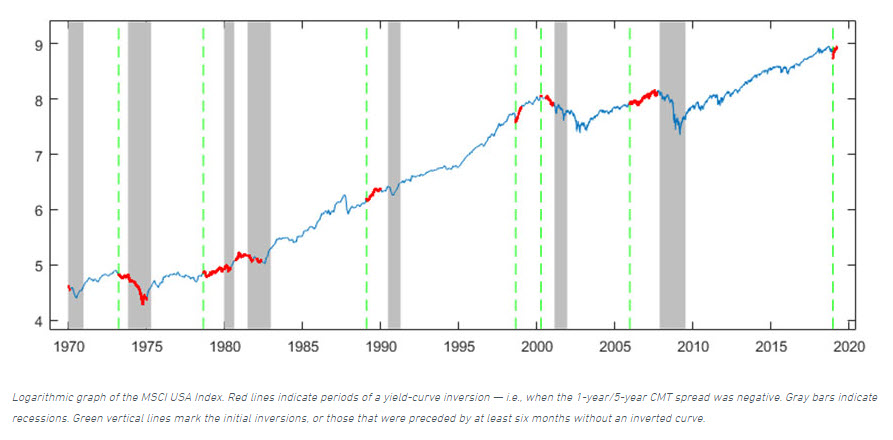

Another type of inversion is in headlines recently: that of the yield curve. An inverted yield curve occurs when longer-term yields are lower than near-term yields, and the witches of Wall Street see this as an ominous omen of impending disaster. That is because each of the previous recessions of the past 50 years was preceded by an inversion of the yield curve. There was also one instance of an inversion that did not portend an imminent recession (August 1998). Still, if you’re out camping and hear a growl, it might be your partner’s stomach, but it might be more prudent to assume it’s a bear.

US Stock Market, 1969-2019, with Recessions (Grey) and Yield Curve Inversions (Green/Red)

Source: MSCI

Source: MSCISo the fact that an inverted yield curve has preceded every recession of the past 50 years would seem to be cause for alarm. But before we hit the panic button, we should understand the context of past inversions in relation to today’s environment.

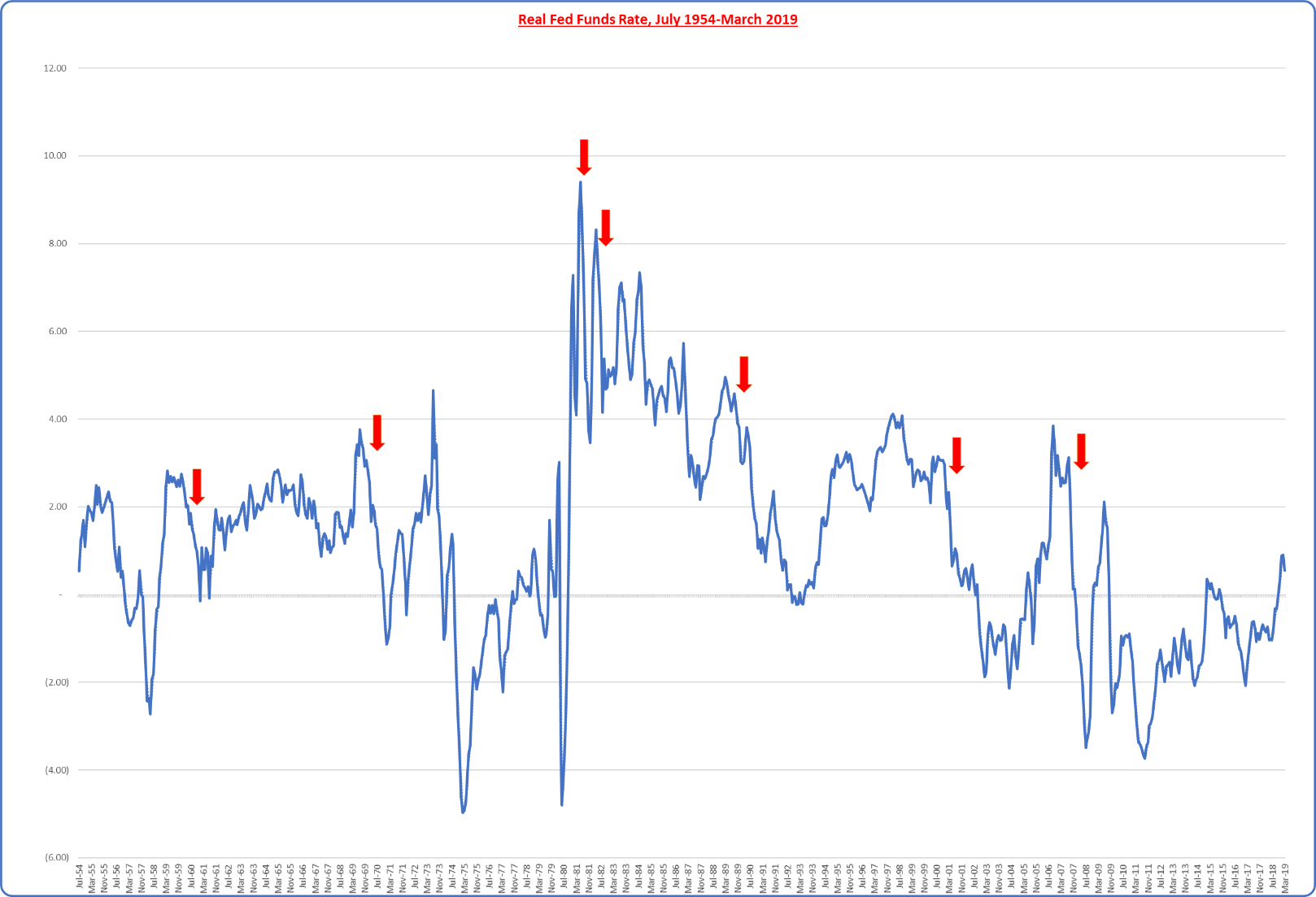

In the past, short-term rates above long-term rates signaled a tightening monetary policy. The Federal Reserve accomplished this tightening by draining bank reserves, thus removing liquidity from the banking system, which responded by curtailing credit, which contracted the economy (the definition of recession). Each previous instance of an inverted yield was thus accompanied by high real rates, a signal of a lack of financial liquidity. The graph below plots the real Fed funds rate since 1954, with the red arrows marking recessions. Each recession was preceded by high real rates (between 3%-9%). Today’s real Fed funds rate is 0.55%.

Source: https://fred.stlouisfed.org/

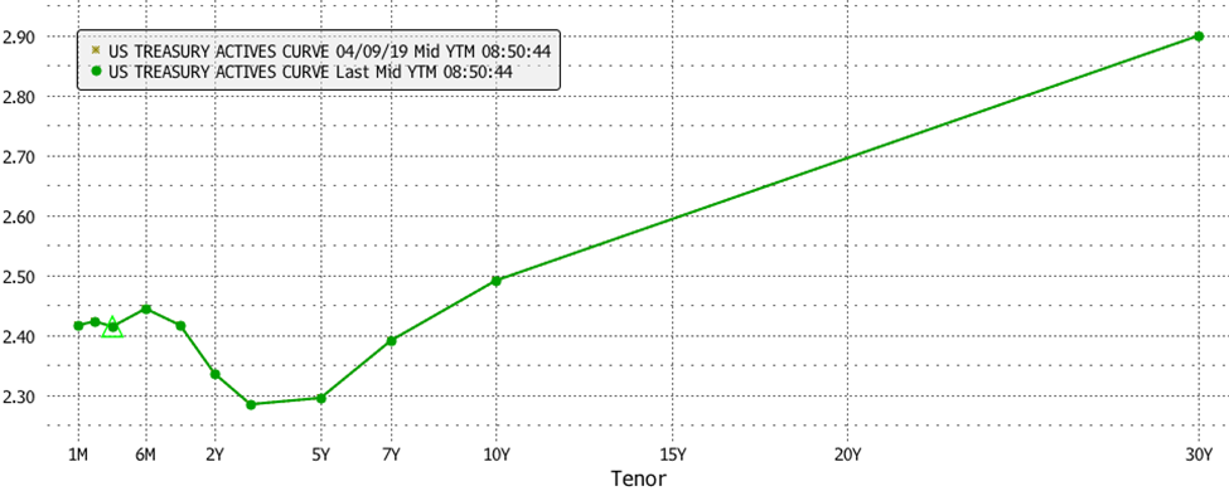

It’s not even clear that the yield curve is even inverted. The front-end is negatively sloped, but the intermediate-to-long end is pretty steeply positive.

Treasury Yield Curve, 9 April 2019

Source: Bloomberg, L.P.

Recessions occurred in the past when monetary policy tightened sufficiently to choke off the availability of credit. This tightening was seen in an inverted yield curve, but also in other indicators of a shortage of liquidity, such as high real interest rates and a shrinkage of banking reserves held at the Federal Reserve. The real Fed funds rate is low, there is approximately $1.5 trillion of excess bank reserves at the Fed and credit spreads are low and stable (see below), default rates are low and stable, interest coverage ratios are high and rising. There is no shortage of liquidity.

US High Yield Index Option-Adjusted Spread, 2010-2019

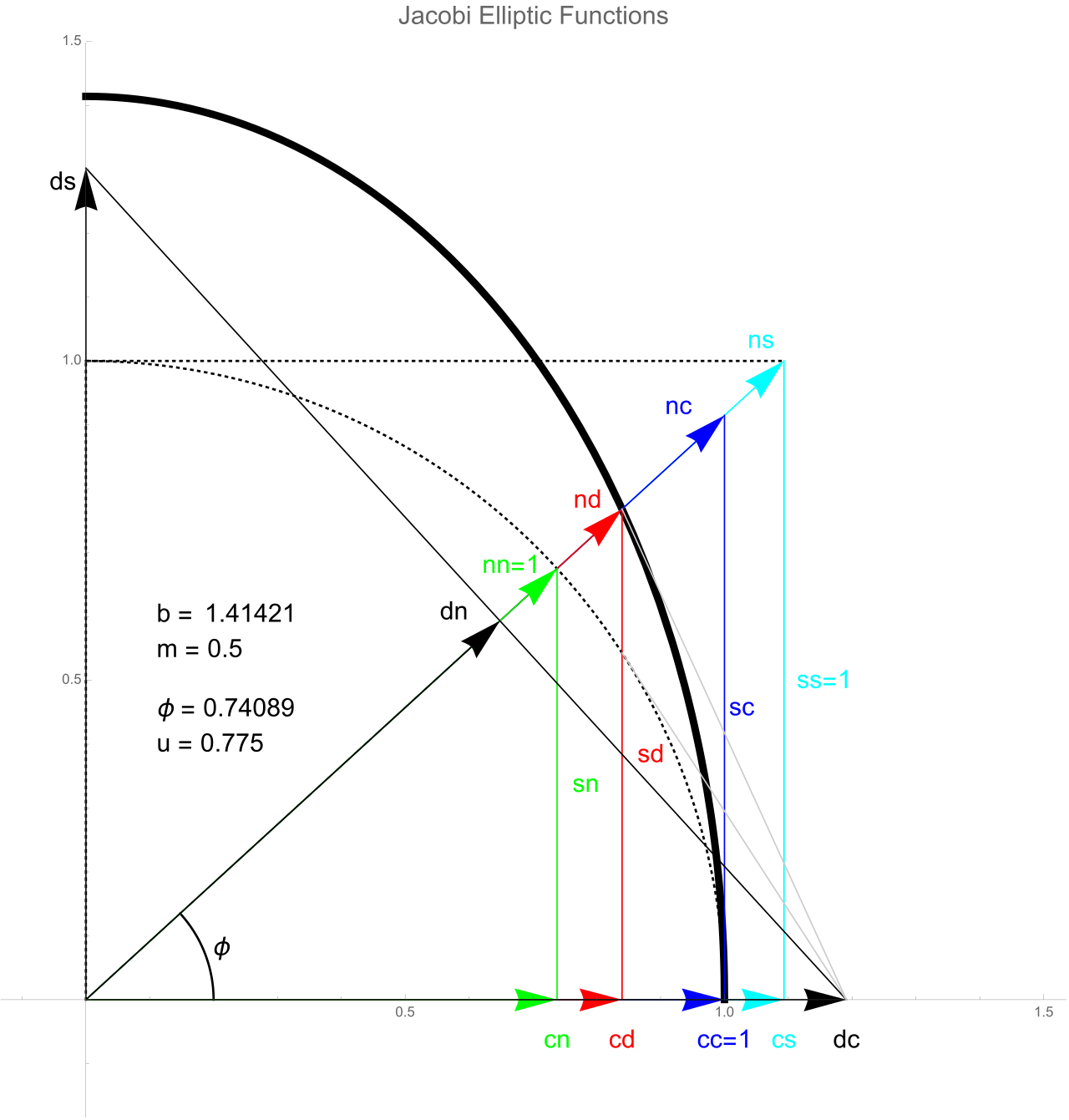

“Inversion,” in addition to its meteorological and yield curve usage, also has a meaning in logic. The great German mathematician, Carl Gustav Jacob Jacobi, said he created his famous eponymous elliptic functions (don’t ask; see graph below) with the approach, “invert; always invert.” (His precise quote was: man muss immer umkehren).

Source: https://commons.wikimedia.org/w/index.php?curid=64896331

Inversion in logic means solving a problem backwards. For example, rather than thinking of the steps needed to achieve a goal, work backwards to consider all the actions that could prevent accomplishing that goal. Inversion emphasizes avoiding the things that could go wrong instead of focusing on the steps that have to go right. In other words, try not to be stupid than strive to be brilliant.

Drawing a direct line from yield curve inversion to recession is neither not stupid nor brilliant.

Print this ArticleRelated Articles

-

![2016 - 1st Quarter Commentary]() 17 May, 2016

17 May, 20162016 - 1st Quarter Commentary

To read more, download the full 16 page PDF: ...

-

![Fireside Reading]() 15 Dec, 2020

15 Dec, 2020Fireside Reading

Since my last update a few months ago (https://www.angelesinvestments.com/institutional-insights/still-beach-reading), ...

-

![Job Growth is Falling. The Sky is Not.]() 2 Jun, 2017

2 Jun, 2017Job Growth is Falling. The Sky is Not.

Today's jobs report was disappointing: only 138,000 net new jobs created in May (the consensus had it pegged at ...

-