-

Wild, Wild East

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Wild, Wild East

Published: 07-13-2015The central planners in Beijing have gotten so much right for the past three decades, that they might be forgiven for believing in their own infallibility. But it’s one thing to shuffle resources around an economy—a road here, an airport there—and quite another thing to dictate supply and demand in a large market. John Major learned the folly of fighting markets in 1992, and there have countless similar experiences both before and since.

Apparently confusing a healthy stock market with a healthy economy, the political powers in China decreed that stock prices should rise, directing banks and other lenders to lend freely to speculators. Margin loans on the “A” share market rose to $371 billion by mid-June, about 10% of the free-float market capitalization. By contrast, margin loans at the NYSE are around $500 billion, or 3% of the NYSE market capitalization. And that’s a record high in New York.

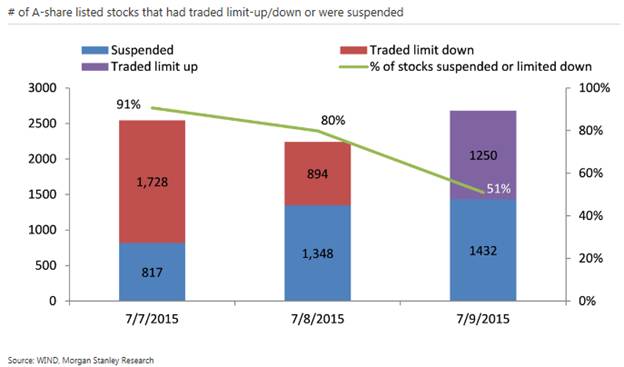

So the astute planners in Beijing decreed that margin lending had gotten ahead of itself, and shut off the spigot. As of last week, margin loans had fallen nearly 40%, to $238 billion, still about 8% of the capitalization of the A-shares market. The market itself fell more than 30%, and on Thursday of last week, the bureaucrats stepped in again to say that was enough, the market should stop falling. The chart below illustrates the extraordinary effect these decrees had on a daily basis. On Tuesday and Wednesday last week, most stocks were either limit-down or simply suspended from trading (91% on Tuesday, 80% on Wednesday), but then on Thursday 51% of stocks traded limit-up.

This is a crazy way to run a market (the oxymoron is not lost: market prices are not “run,” they reflect supply and demand forces). Still, I have some empathy for the bureaucrats. Setting reasonable rules and regulations and then stepping aside must be really hard to do. But they are learning that the alternative—decreeing the daily direction of markets—is even harder.

Print this ArticleRelated Articles

-

![GDP]() 23 Dec, 2014

23 Dec, 2014GDP

Normally, I wouldn't comment on any single economic release, but today's GDP revision adds to the mounting evidence of a ...

-

![Beach Reading]() 20 Jun, 2023

20 Jun, 2023Beach Reading

Most of you know that I don't favor romance novels for reading on the beach (or anywhere else, for that matter, although ...

-

![Yasou!]() 29 May, 2015

29 May, 2015Yasou!

Let me stipulate up-front: I love Greece. Everything about it: the food, the weather, the history, the music, the ...

-