-

Feliz Cinco de Mayo!

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Feliz Cinco de Mayo!

Published: 05-05-2015There will always be a debate about the relevance of history to current conditions. I am firmly in the pro-history camp, but am quick to acknowledge that historical analogies are always imperfect. They are a guide, not a blueprint, for how present events will unfold.

A related debate is how much behavior really changes over time. At the personal level, most of us would like to think that we can progress toward being “better” people: kinder, more sensitive, more empathetic, etc. The reality that is that most of us probably don’t change our behavior very much, despite good intentions. It could be laziness, or that we don’t recognize our faults, or that it’s just difficult to change.

The same observation applies to countries: behavior usually doesn’t really change that much. Certainly, there are exceptions of habitual basket cases that were able to break old bad behavior: former communist countries that shook off the suffocating idiocy of that ideology, (Czech Republic, Poland); or through tenacity and vision transformed an impoverished backwater into among the world’s wealthiest (Singapore); or were able to abandon a culture of dependency and autocracy for competition and democracy (Brazil, tentatively).

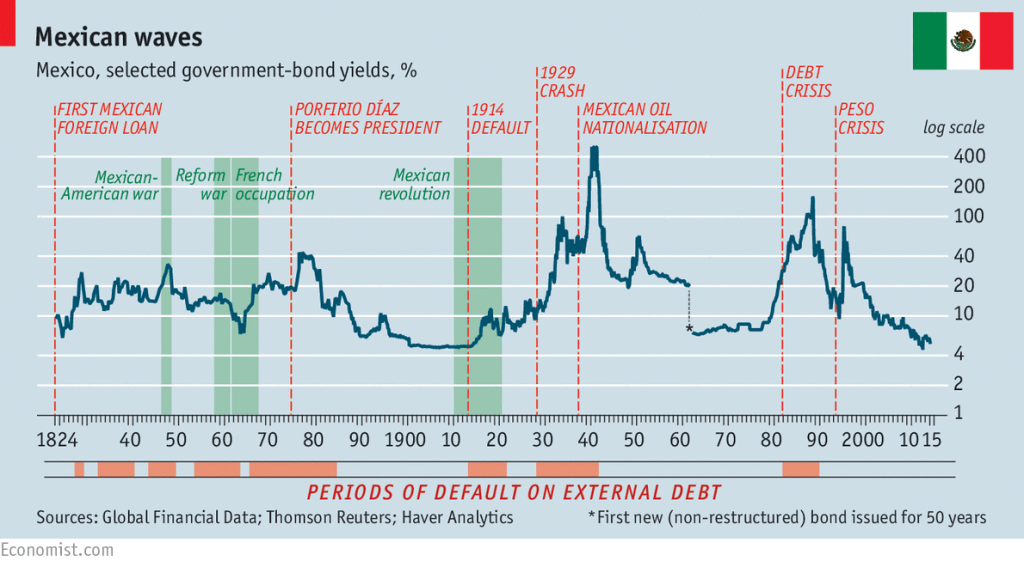

Then there are the habitual addicts, who periodically swear off the drugs of debt and corruption, but predictably lapse back into self-destructive behavior (Greece, Argentina come to mind). Last week Mexico issued a 100-year bond, denominated in euros, at a yield of just 4.2%. Mexico has made a lot of economic progress in recent years, and investors may be justified in believing that Mexico has broken with its bleak history of defaults, as the chart below sadly illustrates. Alternatively, investors’ judgment could be clouded by central bank policies that promote lending money for a century to a country that has spent a good portion of the past 200 years in default. I suspect we’ll know the answer well before 2115. Feliz Cinco de Mayo!

Print this ArticleRelated Articles

-

![Valuation]() 21 Apr, 2015

21 Apr, 2015Valuation

Most observers would agree that equities are rich (expensive, overpriced, etc.). Corporate profits are at record highs, ...

-

![Rupture]() 28 Jun, 2016

28 Jun, 2016Rupture

[nota bene: this is a long one; if you dont have time, just skip to the summary at the end. I promise, no hard ...

-

![Shock (Part 1)]() 22 Nov, 2016

22 Nov, 2016Shock (Part 1)

Shock, a sudden drop in blood flow, is a serious medical condition. Untreated, it can quickly be fatal. There are ...

-