-

Under My Thumb

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Under My Thumb

Published: 11-20-2015As Mick Jagger sang (screeched?) 50 years ago. The song was about turning the tables on a domineering woman (The girl who once had me down).

A bit sexist, to be sure, but the song came to mind when looking at this week’s government bond auctions around the world (isn’t my life fascinating?). Our clients have been complaining about the low yields they are earning (as if I controlled that), and my response has been: count your blessings. You can lend the US government money for a year and earn half of a percent (50 cents per $100), or extend the loan for 2 years and earn almost 1% (91 cents per $100 to be precise). That’s infinitely more than almost anywhere else in the developed world.

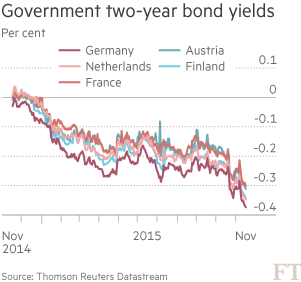

In Europe, all short-term government debt (except Greece and Portugal) carry negative yields. Two-year German bunds yield -0.38%, a bargain to Sweden’s -0.47% and Denmark’s -0.70%. Even Portugal (!?) sold 1-year bonds this week with negative yields. Yields in Europe have been negative for the past year, and are getting more so (Chart below). So while the yields are negative, prices have risen steadily, making those investors seem pretty smart (so far).

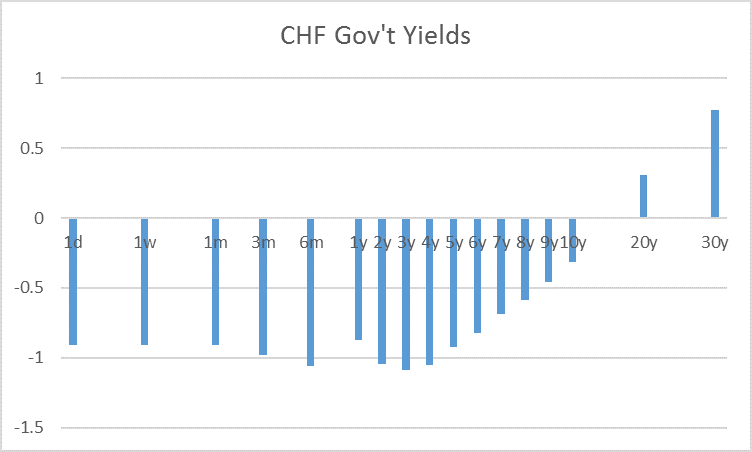

Most extreme is Switzerland (of course). Mattresses are (apparently) in short supply in Switzerland (so what do people sleep on?), because rather than sticking cash under a mattress, ensuring you’ll get the same amount when you want to spent it later, investors are pleading with the Swiss Central Bank to lend it money for the next decade with the promise of returning a little less of it (see below—positive yields in Switzerland are found only beyond 20 years).

Why this is, is a deeper question. I’ve talked about this in my quarterlies, and it looks like it’s a topic we’ll have to come back to. For now, we’re all under the thumb of central banks, who have us, and are keeping us, down.

Print this ArticleRelated Articles

-

![Sunrise or Sunset: Thoughts on a Post-Pandemic World (Part 2)]() 29 May, 2020

29 May, 2020Sunrise or Sunset: Thoughts on a Post-Pandemic World (Part 2)

In Part 1 ...

-

![Bring Home the Bacon]() 16 May, 2019

16 May, 2019Bring Home the Bacon

Bacon sure is popular. McDonalds, which probably has the best pulse on Americans culinary tastes, introduced Cheesy ...

-

![Petropolitics]() 2 Dec, 2014

2 Dec, 2014Petropolitics

For the past few years, oil has held steady at around $100/barrel, as supply and demand were largely held in check. ...

-