-

Jolt

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Jolt

Published: 08-25-2015Two weeks ago (13 August, No Panic (Yet)) I noted that the renminbi devaluation was officially described as a modest alignment with market forces, which may have been true, but that it was strongly indicative of protracted weakness in China’s economy. I saw no need to panic two weeks ago, but last week would have been more timely; the “(Yet)” part of the title came upon us with a fury. Yesterday, US stocks lost more than 3%, but the intraday move was cumulatively more than 25%, up and down 5,000 Dow points.

But US (or European) markets are not the drivers of this volatility, it’s China. When the world’s second largest economy, accounting for the majority of the world’s growth in recent years, falters, the ripples are more like massive waves pounding the shores of economies dependent on China’s growth.

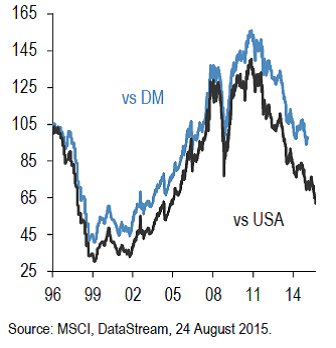

China’s equity market is down 40% from its recent high, bringing all Emerging Markets down by 28% in the past four months. This is close to the 29% drop in EM in mid-2011, although not (yet) as bad as the 66% drop in 2008. While this is a substantial move in a short time, it only represents a continuation of the trend for the past four years: relative to the the US, emerging markets are off 50% (see Graph below: MSCI EM Index vs. DM and US).

Global growth, again, led by China, is softening, and that fact impacts the US economy. But it affects us to a much lesser extent than almost any other country. The most recent economic data remain supportive of growth: 65 consecutive months of job growth (the most since at least the 1930s), record auto production, and a strengthening housing market, as we learned this morning: new home sales are up more than 25% from a year ago, the average price up nearly 5%, and inventory down to 5.2 months.

The last week has certainly been volatile, and investors should expect these periodic market shocks. But the big picture for me remains unchanged: there is little risk of a recession in the US economy, the commodity supercycle ended a few years ago, government bonds offer no real return, and equities are in a structural bull market that will see new highs in the coming years. But we won’t get there without occasional (even frequent) jolts, which is what we’ve just experienced.

Print this ArticleRelated Articles

-

![Laboring]() 24 Mar, 2016

24 Mar, 2016Laboring

In some respects, this is a golden age for labor. The unemployment rate has dropped to 4.9% from a high of 10% in ...

-

![Negative Yields]() 19 Mar, 2015

19 Mar, 2015Negative Yields

One of the (many) perplexing phenomena facing investors is the persistent (and falling) low yields on government ...

-

![Whats Down With Oil?]() 15 Apr, 2020

15 Apr, 2020Whats Down With Oil?

I have always found that most things in life can be explained by basic economics. Well, some things, for sure. The most ...

-