-

I'm Swiss

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

I'm Swiss

Published: 10-13-2015No question, this has been a challenging year. Virtually every financial asset class is struggling. Stocks are down, bonds are down, gold is down, oil is down. US is down, non-US is down. Large caps down, small caps down. Industrials, financials, health care: all down. High-grade bonds, low-grade bonds: down.

Japan’s economy has flat-lined, Europe rejoices if GDP growth is fractionally above zero, and Chinese passengers should assume the crash position before their economy hard-lands. And in the US, there are a handful of crazy people running for president, some even leading in the polls.

Most of the above statements are true, yet I’ve argued we should stick with our long-term strategy. I see each of these elements as part of a normal cycle of events. Sometimes markets get ahead of themselves, sometimes they panic when fearing they are behind events.

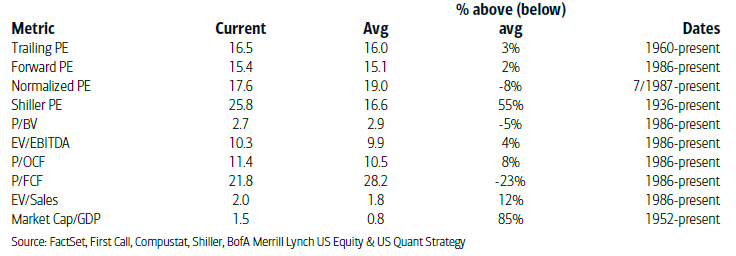

The economy, which still matters to asset prices, is growing right around 2.5% p.a., the average of the past 6-7 years. Equity valuations are pretty close to long-term averages (see table below). I just don’t believe the end is nigh, or that asset prices are grossly out of balance. Like Switzerland, I’m pretty neutral. Like the Swiss, that’s a little boring. Sorry (both for being boring and for offending my Swiss friends).

Print this ArticleRelated Articles

-

![Basketball is Life]() 28 Oct, 2021

28 Oct, 2021Basketball is Life

The last commencement address I gave was in 1978. No one remembers what I said. I know this for three reasons:1. I dont ...

-

![A Year-End Thought]() 31 Dec, 2015

31 Dec, 2015A Year-End Thought

This week, my college basketball team visited southern California, and I was lucky enough to spend some time with them ...

-

![Feliz Cinco de Mayo!]() 5 May, 2015

5 May, 2015Feliz Cinco de Mayo!

There will always be a debate about the relevance of history to current conditions. I am firmly in the pro-history camp, ...

-