-

Still in Neutral

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Still in Neutral

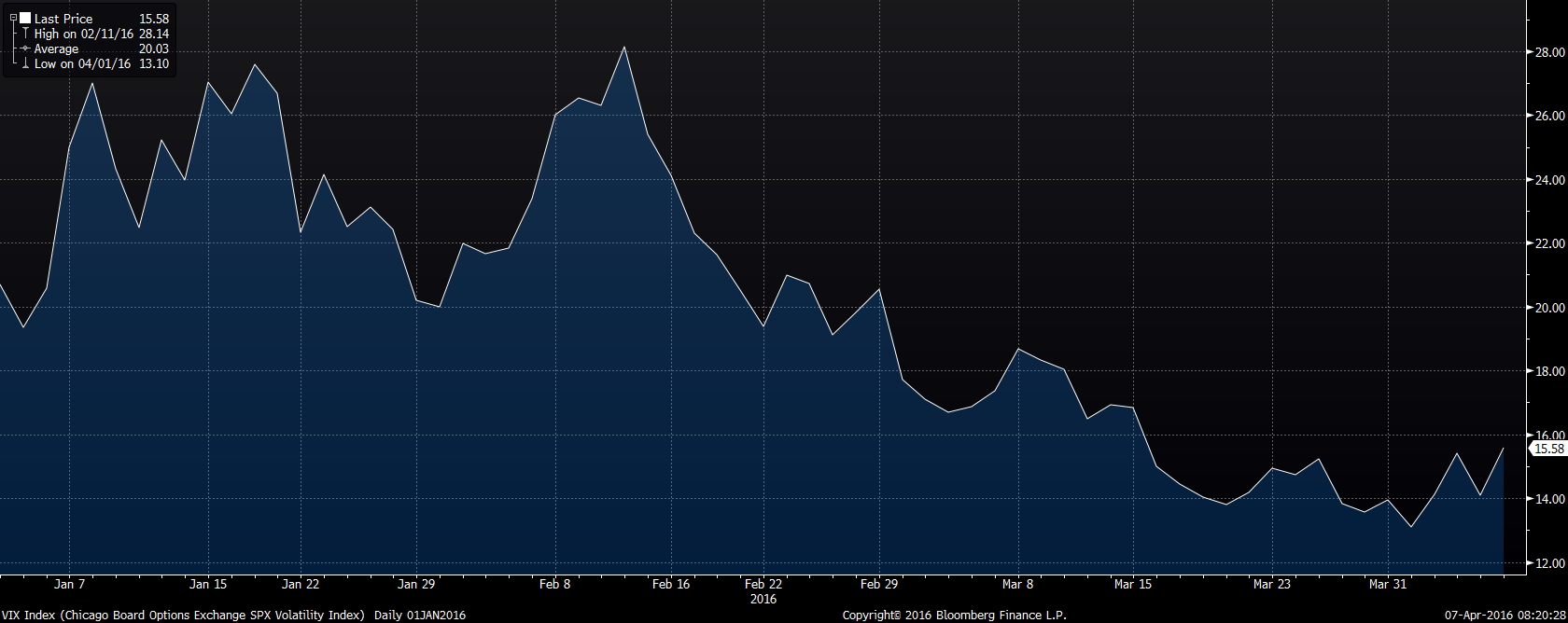

Published: 04-07-2016The first quarter began with a bang and ended with a whimper. At least, that’s the message from the VIX (volatility index—see below). Bouncing around an elevated level of around 28 for much of January and February, the VIX fell 50% to 14 by the end of March.

At a high level, we have maintained a pretty neutral stance in our portfolios. I didn’t think the sell-off in the beginning of the year was the beginning of a new bear market, so we held our ground. The March rally brought global equities all the way back to flat for the year, but I don’t see cause to celebrate much. The global economy is sputtering along, and I haven’t seen any serious discussion, much less action, toward addressing the long-term declines in productivity and growth rates.

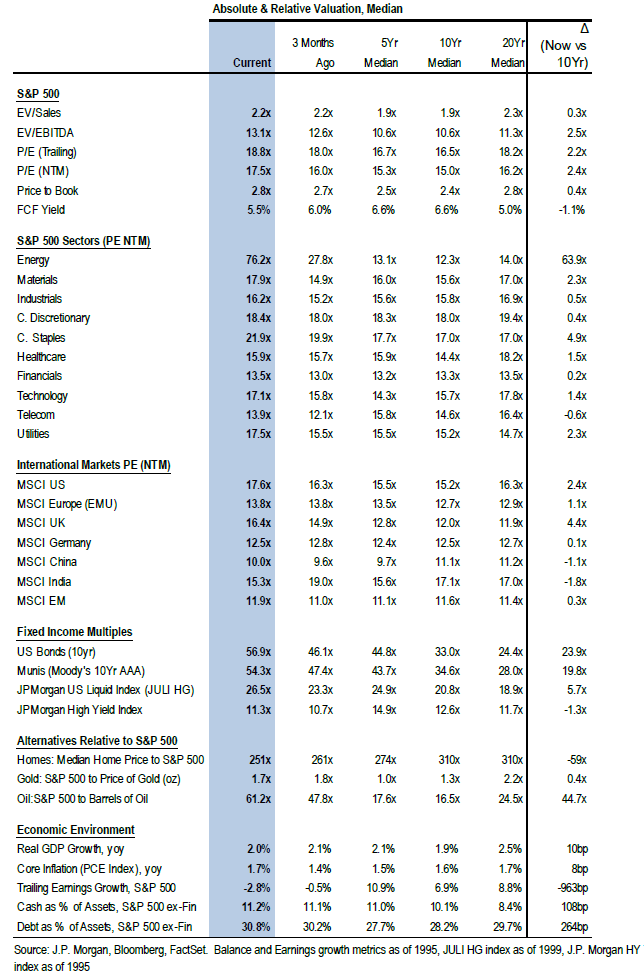

Valuations are fine, generally in-line with where they “should” be (see table below, courtesy of J.P. Morgan). I suppose oil and (US) homes look a bit cheap, and government bonds expensive, but take valuation measures as the blunt instruments they are. Equities, broadly, are close to fair value, in my opinion.

So, our models, at the high level, are in-line. There are some interesting, idiosyncratic ideas we are seeing around the world, but I don’t (yet) feel compelled to add risk broadly, or to bury gold in the backyard. Still in neutral.

Print this ArticleRelated Articles

-

![Shock (Part 1)]() 22 Nov, 2016

22 Nov, 2016Shock (Part 1)

Shock, a sudden drop in blood flow, is a serious medical condition. Untreated, it can quickly be fatal. There are ...

-

![For What It's Worth]() 21 Aug, 2017

21 Aug, 2017For What It's Worth

In the summer of 1966, throngs of young people crowded the Sunset Strip in Los Angeles to hear their favorite bands. ...

-

![THE G.O.A.T.]() 1 Aug, 2022

1 Aug, 2022THE G.O.A.T.

John Harris owned a skating rink in Pittsburgh. In 1940, he invited Olympic star Sonja Henie to skate between periods of ...

-