-

Long Term

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Long Term

Published: 05-26-2015In much of life, certainty dissipates with time. Weather forecasts are pretty accurate over the next 24 hours, a little better than a coin flip over the next week, and worthless a month from now. The same holds for our daily, mundane events: the people we will see today, the food we will eat tonight, we know what to expect. But beyond a week, a month, we just don’t know exactly what the day will bring.

For investors, the opposite is true. The day-to-day fluctuations of the markets are coin flips, impossible to predict. But over the course of years, the pattern becomes clearer, not cloudier.

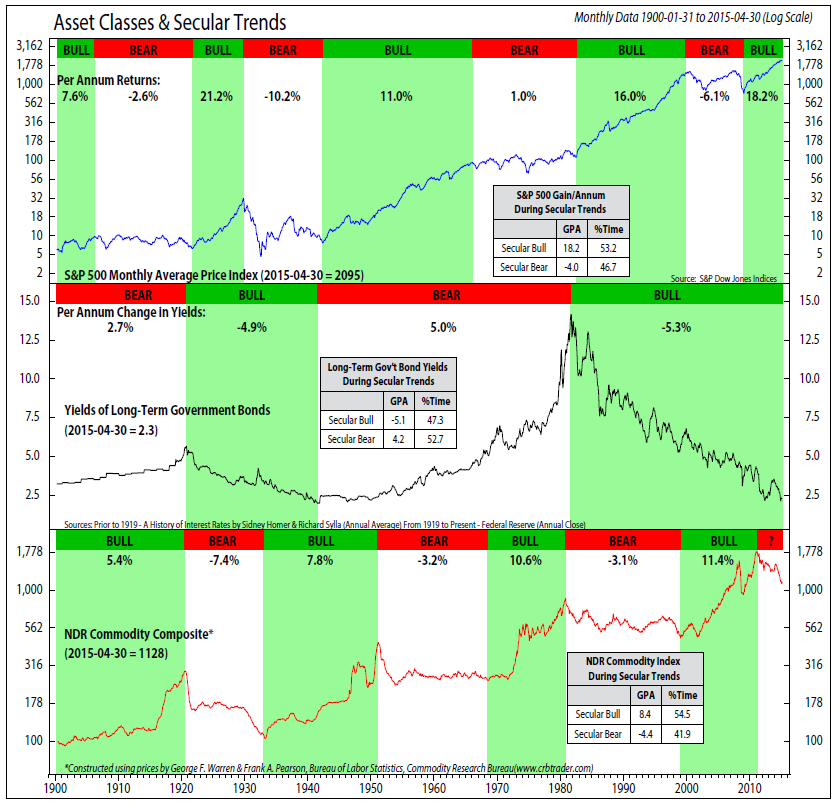

The chart below (courtesy Ned Davis Research) shows the performance of equities, bond yields and commodity prices since 1900. With this horizon, a few observations may be made. One, is that the volatile assets classes (equities and commodities) have had bull-and-bear markets more frequently than bonds. Why this is the case is unclear, that is, why would asset classes with higher short-term volatility also have more frequent long-term booms and busts? I’m not smart enough to know, only to observe.

Secondly, the bull market in bonds is likely much closer to its end than to its beginning. That insight, coupled with the current yield on bonds, leads to the equally insightful prediction that bond returns are likely to be very modest, possibly negative in real terms, for the coming multi-year or -decade bear market.

Thirdly, commodities have a begun a multi-year bear market and equities a multi-year bull market. But because these two assets classes have very high short-term volatility, we should expect to see weeks or months of counter rallies. These do not negate the structural trends of bear (commodities) and bull (equities).

Most would agree that bonds and commodities are either in or will soon be entering bear markets. The secular bull equity outlook is more controversial, with opposition resting on two principal arguments: the bull market has already lasted longer than most, and valuations are high.

I don’t disagree with either argument, but offer two thoughts. First, bull (or bear) markets don’t die of old age. Historically, excesses build up over time, and policy responses are inevitably inadequate, which is why trends don’t go on forever. But rather than focus on time, better to watch for signs of excess (leverage, speculation) or policy errors. There are hints of both: record debt issuance with little or no covenant protection; questionable valuations for certain start-ups; redistributive tax/fiscal policies. But we are not near the levels of speculative excesses that marked the end of bull markets in 2008, 2000, 1968, 1929.

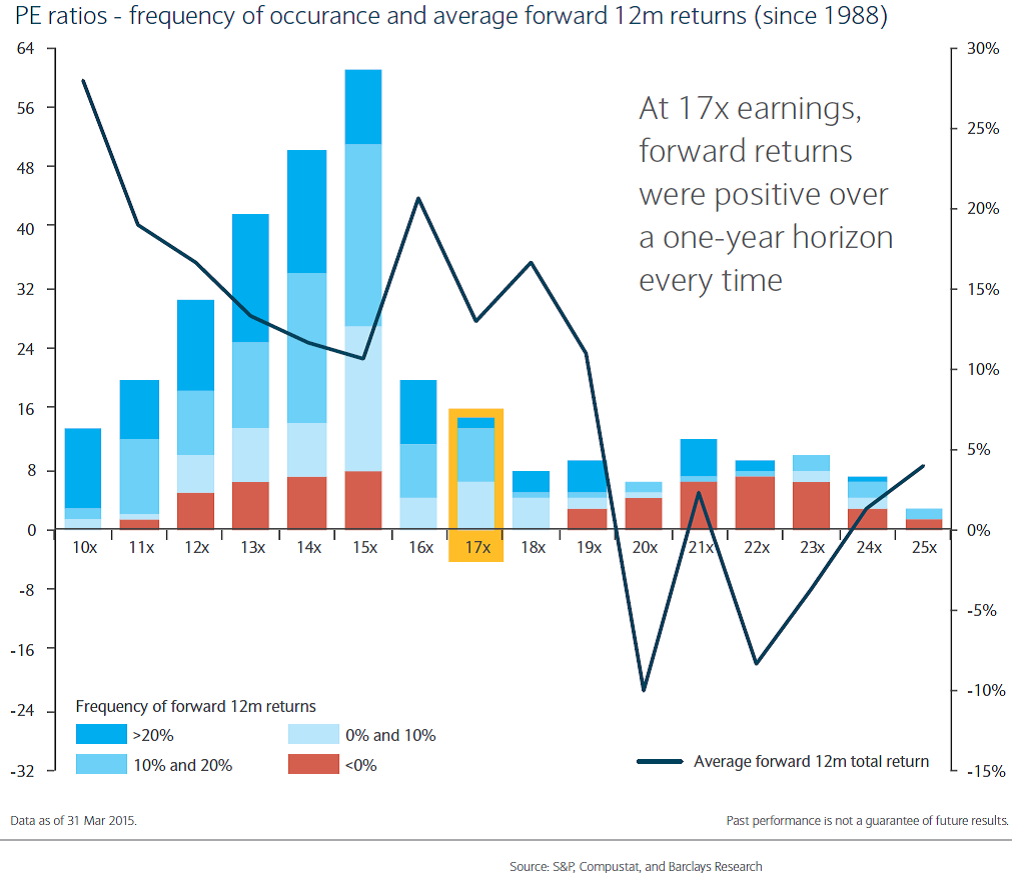

Secondly, most equity valuation measures look stretched, but that argues for modest forward returns, not an end to a bull market. That said, and remember I’ve conceded that valuations are a bit high, the combination of strong profits and low inflation may warrant above-average valuations. As we see from the chart below, forward returns are often poor when valuations are high, but they can also be poor when valuations are low (probably reflecting a worsening economic backdrop than even anticipated). But there is a (very) happy median valuation where future returns are moderate, but almost always positive.

I’m not (any longer) a trader. I’m an investor. The only way to be a successful investor is think, and act, for the long-term. In the short-term, changes in asset prices should have no meaning to us. We should care primarily about whether we have enough liquidity to meet all of our spending needs. Ideally, we’ll have a little more to be able to take advantage of asset bargains if prices fall. Long-term, our true investment horizon, we care not a whit about short-term volatility, only about protecting and growing our funds in excess of purchasing power.

Asset prices have historically exhibited trends over years and decades. I believe they always will. In the short-term, we may adjust portfolios at the margin in response to near-term fluctuations, but we should not lose sight of the bigger trends, and maintain our course even through the occasional, inevitable, storm.

Print this ArticleRelated Articles

-

![For What It's Worth]() 21 Aug, 2017

21 Aug, 2017For What It's Worth

In the summer of 1966, throngs of young people crowded the Sunset Strip in Los Angeles to hear their favorite bands. ...

-

![Spreads]() 18 Nov, 2014

18 Nov, 2014Spreads

An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much ...

-

![Under My Thumb]() 20 Nov, 2015

20 Nov, 2015Under My Thumb

As Mick Jagger sang (screeched?) 50 years ago. The song was about turning the tables on a domineering woman (The girl ...

-