-

Hope and Reality

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Hope and Reality

Published: 04-06-2017

Why is everyone so happy? Well, maybe not everyone, but a lot of people are as optimistic as they’ve been in a long while. Start by looking at consumer confidence, as collated by the Conference Board below. Confidence is at the highest level in the past five years (see graph below); in fact, confidence is only a little shy of its all-time peak in September 2000 (which, ominously, marked the top of the great Internet bubble).

Conference Board Survey of Consumer Confidence, 2011-2017

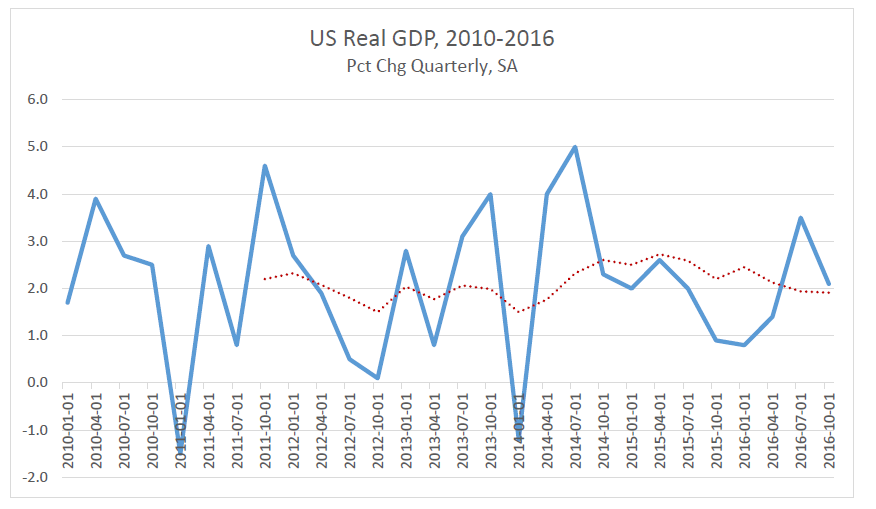

One finds the same results in nearly all the surveys, from consumers to small businesses to baseball fans (except, maybe, Padres fans, whose team will struggle to win a third of their games this year). Is this optimism justified? Well, if you look at the actual data, the economy is doing fine, plugging along. By my count, over the past month, positive economic surprises are outpacing disappointments by about a 4/3 ratio. Labor and housing data have been especially strong, manufacturing and construction a little light (although bad weather may account for some of that). Looking at the broadest measure of economic output, gross domestic product (GDP), it has been remarkably stable over the past five years, at around 2% p.a. (see graph below, showing quarterly changes along with the two-year moving average).

Source: Bureau of Economic Analysis

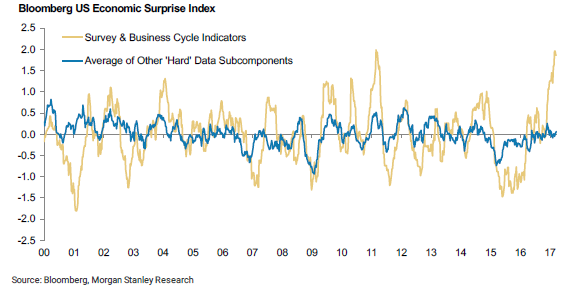

So, there’s not been a lot actual change in the trajectory of the economy, in contrast to the huge jump in confidence recently. In fact, the gap between hope and reality is the widest on record (see graph below).

So, why is everyone so happy? We can’t be sure, but we had an election that promised to sweep away the old, sclerotic ways of Washington, to be replaced by swift and decisive actions: cutting taxes, culling regulations and, especially, creating jobs (although, it should be said, the economy has created 12 million jobs over the past five years, and I’m not sure we’re going to (or can) do any better over the next five). So that’s pretty exciting.

If this explanation is right, we will keep our eyes (and Twitter accounts) on Washington. The first attempts at swift, decisive action was a little less than successful, but there will be more cracks at the bat. Like the baseball season, it’s early in the season.

Print this ArticleRelated Articles

-

![Negative Yields]() 19 Mar, 2015

19 Mar, 2015Negative Yields

One of the (many) perplexing phenomena facing investors is the persistent (and falling) low yields on government ...

-

![EM Thoughts...Not There Yet]() 25 Nov, 2014

25 Nov, 2014EM Thoughts...Not There Yet

Successful investing is frequently about balancing valuation with growth prospects. We would all love to invest in cheap ...

-

![Party Like It's 1999?]() 12 Jun, 2015

12 Jun, 2015Party Like It's 1999?

Some observers point to the eye-popping valuations for companies with little revenue (WhatsApp, e.g., bought by Facebook ...

-