-

No Panic (Yet)

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

No Panic (Yet)

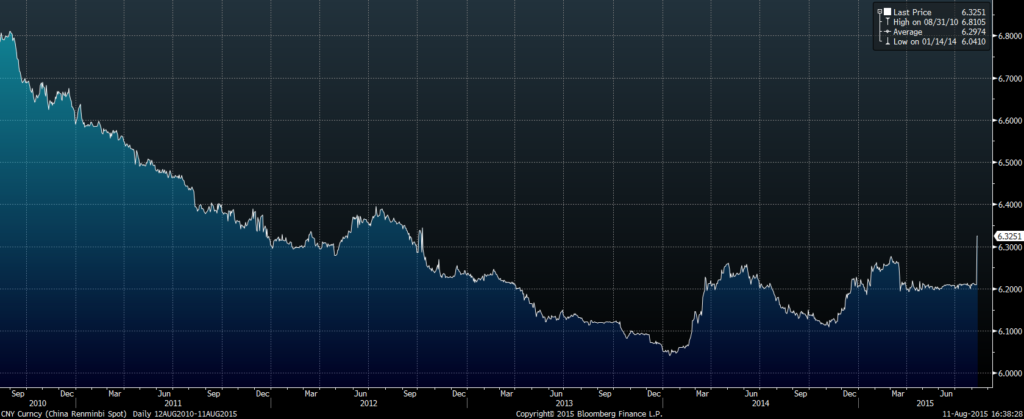

Published: 08-13-2015Earlier this week, China devalued its currency 1.9% against the US dollar. On one level, this is not a big deal. China’s currency has been appreciating considerably for many years (see Chart 1 for the last five years; note the scale is inverted). Even in the past year, the yuan is down just 3.5%, whereas our largest trading partners—the Canadian dollar, Mexican peso, yen and euro—are each off 15-20%. So, who cares?

Perhaps we need a distraction from the Donald Trump – Megyn Kelly spat, and mid-August is typically a sparse news period, but some pundits are trying to stir concerns that this move (a) presages a coming collapse in the yuan, and/or (b) will stop the Fed from tightening rates next month, thus the devaluation is a significant event. Support for Argument (a) comes from the numerous historical examples of countries failing to support a failing currency. Argument (b) rests on the assumption that the RMB devaluation is a de facto tightening of US monetary conditions and the Fed will be hesitant to tighten further.

I don’t see the action by the People’s Bank of China necessarily leading to either event. But neither do I fully accept the official explanation that the government simply wants to be more responsive to market forces.

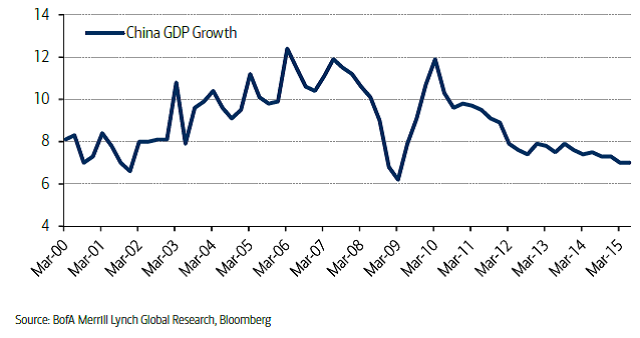

GDP is growing (officially) at a 7% pace, the lowest in many decades (see graph below for the past 15 years). Many believe, though, that the official numbers overstate the growth rate, which may be closer to half the official number.

As I see it, the devaluation is a clear signal that the Chinese economy is struggling, requiring more stimulus than the steps previously announced, such as easing credit and supporting stock prices. A collapse in yuan is not going to happen, not with $4 trillion of foreign reserves, and the Fed is not going base its policy on a 1.9% decline in the RMB. But China’s economy does impact the world, and a significant slowdown in its growth will be felt throughout the global economy. This small devaluation does not mean there is major turmoil ahead, but it does say that China’s growth is sputtering, and that does matter to all of us.

Print this ArticleRelated Articles

-

![Shock, Part 3 (The End of Pax Americana)]() 13 Dec, 2016

13 Dec, 2016Shock, Part 3 (The End of Pax Americana)

We are all trying to make sense of the election of Donald J. Trump to the presidency, and a few weeks ago I outlined the ...

-

![Where Have All the Bonds Gone?]() 9 Feb, 2015

9 Feb, 2015Where Have All the Bonds Gone?

Apologies to Pete Seeger for stealing his song lyric, but I think bonds and flowers are sufficiently different that he ...

-

![Drop (in the bucket)]() 15 Sep, 2015

15 Sep, 2015Drop (in the bucket)

Markets will fluctuate, as Pierpont Morgan caustically observed. And "fluctuate" means down as well as up. Perhaps I, ...

-