-

Spreads

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Spreads

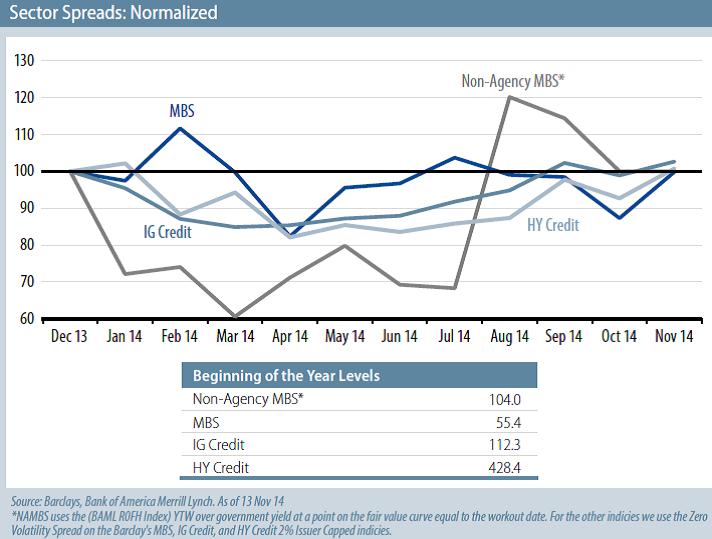

Published: 11-18-2014An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much unchanged from the start of the year. This, despite the rally in US equities and solid economic growth. Thus, Ken concludes, spread products remain attractive.

I agree. There are numerous risks in fixed income, but that’s often the case. An economy that suddenly slumps will likely cause spread widening (although likely offset by rising bond prices). An unexpected economic boom could push bond prices lower (but spreads should hold true, if not tighten). An environment of moderate growth and low inflation should be favorable to spread products. And that’s my view.

Print this ArticleRelated Articles

-

![(Not Yet) Beach Reading]() 14 Apr, 2020

14 Apr, 2020(Not Yet) Beach Reading

Its not quite beach weather yet, but as we are all locked in our houses waiting out this virus, we may have found a ...

-

![Shock, Part 4 (Divided We Are)]() 21 Dec, 2016

21 Dec, 2016Shock, Part 4 (Divided We Are)

We began this series with a review of the likely economic policies and their implications of the new Trump ...

-

![QE Impact?]() 31 Oct, 2014

31 Oct, 2014QE Impact?

QE3 (the policy, not a new Cunard ship) was launched 2 years ago and ended this week. The expanded it balance sheet by ...

-