An Outsourced Investment Office for:

Institutions

Private Wealth

An outsourced investment office enhancing our clients' ability to serve their constituents, communities, & families by providing the resources of a comprehensive investment office and the experience and framework necessary for sound governance.

-

Our Firm Welcome to Angeles

-

Angeles Investments is driven to be an innovative leader in managing investment programs, globally recognized for our positive impact on our clients and industry.

Read more about: Institutional OCIO & Advisory Private Wealth & Family Office

We embrace intense passion for what we do, focused and undistracted in our purpose. We act with unquestionable integrity, serving as a trusted steward and long-term partner with our clients. We seek superior results, as investment success provides expanded ways for our clients to achieve their mission.

We invite you to explore our website and discover how our experienced team can help you achieve your unique investment goals.

-

![Who We Are]()

-

Our People Who We Are

Founded in 2001, Angeles is a multi-asset investment firm, building customized portfolios for institutional and private wealth investors. Working as a seamless extension of our clients, our investment office strives to offer world class proprietary research and portfolio implementation, along with comprehensive back office support.

Get to know our team

-

Our Promise The Angeles Difference

-

We aspire to be the most respected and admired investment manager, globally recognized for our positive impact on our clients and industry. Our clients come first in how we think and the actions we take. Their mission and passion inspire us to develop custom investment programs to meet unique investment needs. As a result, we have thoughtfully and intentionally built an investment organization which we believe is second to none.

Our Details At a Glance

-

$46.6B

in Assets* $7.1 Billion Discretionary

$36.9 Billion Advisory

$2.6 Billion Private Wealth -

25+ Years Investment Officers Average Industry Experience

-

20+ Years in Business

-

Independent 100% Employee Owned

-

B Corp™ Certified

-

GIPS®** Compliant

-

PRI Signatory

*As of 9/30/2025. OCIO assets represent SEC regulatory assets under management. For the $36.9 billion in advisory assets, Angeles does not have discretion over the asset allocation decisions but does charge a fee. **Angeles claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

-

-

![Greenwich Quality Leader]()

-

Greenwich Best Investment Consultant

Angeles has been named a 2025 Greenwich Best Investment Consultant among midsize consultants. Angeles is the only advisor in this category awarded this distinction for eight consecutive years.

Read more about GreenwichAngeles Investments was designated as a Greenwich Best Investment Consultant among midsized advisors in the 2017, 2018, 2019, 2020, 2021, 2022, 2023 and 2024-2025 studies. Angeles does not pay to have its clients participate in the study. Ratings are based on a subset of Angeles clients only; your experience may be different. This award evaluates the quality of services previously provided and is not indicative of Angeles' future performance.

-

-

-

Angeles is a Certified B Corp™

We use business as a force for good™. We're proud to be recognized for putting people and planet right up there with profit.

Read more about Angeles' certification* The recertification was given by B Lab Global on August 1, 2025, and will expire August 1, 2028, at which time Angeles will go through the recertification process again. Angeles pays an annual fee to maintain this membership. ** Angeles Wealth was not examined in the certification process.

-

Insights + Media

-

-

CIO Insights

-

![4th Quarter 2025 - Garbo]() 6 Jan, 2026

6 Jan, 20264th Quarter 2025 - Garbo

What do a movie star and a Spanish poultry farmer have in common? No, that's not the beginning of a joke, but a connection between two mysterious private lives hidden by their public personas, and the deception that changed the course of WW2.

-

![Fireside Reading]() 16 Dec, 2025

16 Dec, 2025Fireside Reading

As we approach the holiday season, I hope everyone has time to spend with family and friends, and a good book. Not necessarily in that order. Here are my latest ...

-

-

-

Angeles Insights

-

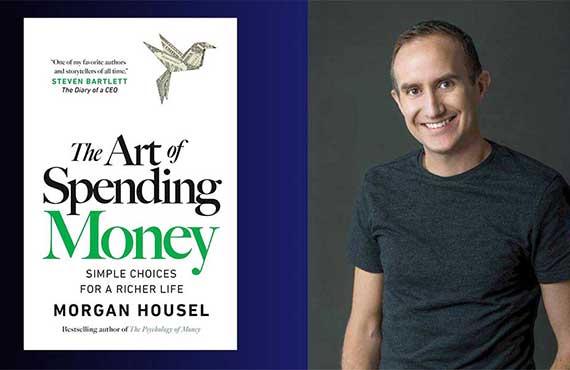

![AWM Speaker Series Featuring Bestselling Author Morgan Housel, January 2026]() 22 Jan, 2026

22 Jan, 2026AWM Speaker Series Featuring Bestselling Author Morgan Housel, January 2026

Inspiring the Angeles Community by bringing together industry experts and thought leaders. Join us for our second live fireside chat with bestselling author Morgan Housel, hosted by Angeles Wealth Partner Ann Deaton and Managing Director Rick Nott.

-

![Year End Newsletter 2025]() 4 Dec, 2025

4 Dec, 2025Year End Newsletter 2025

We would like to share some time-sensitive information as well as various planning strategies with you as we wrap up 2025.

-

-

-

News

-

![Rethinking Risk: Why Traditional Strategies Might Fail Modern Investors]() 26 Jan, 2026

26 Jan, 2026Rethinking Risk: Why Traditional Strategies Might Fail Modern Investors

In a recent article for Financial Advisor, Rick Nott, managing director at Angeles Wealth, challenges backward-looking risk models and one-size-fits-all questionnaires that overlook the emotional and behavioral realities behind financial decisions.

-

![Treasury Yields are Little Changed as Investors Digest Economic Data]() 22 Jan, 2026

22 Jan, 2026Treasury Yields are Little Changed as Investors Digest Economic Data

"The reality is economic growth is stronger than the market seems to believe, and inflation remains steady... which means that monetary policy going forward is likely to be a lot more cautious than perhaps the market expects," said Michael Rosen.

-

-

-

Press Releases

-

![Angeles Wealth Management Acquires XO Capital, Launches Angeles Family Office]() 13 Jan, 2026

13 Jan, 2026Angeles Wealth Management Acquires XO Capital, Launches Angeles Family Office

AWM today announced the acquisition of XO Capital, a boutique firm that offers comprehensive family office and investment management services. This acquisition marks the launch of Angeles Wealth's family office affiliate, Angeles Family Office.

-

-

-

Market Updates

-

![December 2025 Global Market Index Performance]() 2 Jan, 2026

2 Jan, 2026December 2025 Global Market Index Performance

Global equity and bond markets delivered mixed results in December. The S&P 500 returned 0.1%, the MSCI ACWI IMI increased 1.0%, and developed non-U.S. equities (MSCI EAFE) increased 3.0%. In the U.S., value stocks outperformed growth...

-