-

![Michael Rosen]()

-

Investment Insights are written by Angeles' CIO Michael Rosen

Michael has more than 30 years experience as an institutional portfolio manager, investment strategist, trader and academic.

YOGI

Published: 09-24-2015

Baseball, more than any other sport, by far, has drawn its share of colorful characters. I don’t know why that is, but it is. This week, we lost one of the greatest, maybe the greatest, of all-time, with the passing of Yogi Berra.

Yogi was easy to underestimate. He was barely over 5 1/2 feet tall, pudgy (i.e., kind of fat), with a face that looked like a child put together with a play set. His malapropisms were frequent and famous (example: on Yogi Berra Day in his hometown of St. Louis he thanked the crowd for making this day necessary). He reportedly asked a friend to cut a pizza in four slices because he wasn’t hungry enough to eat six. Not very smart, perhaps, although he managed two different teams to league pennants. As a player, he was a 15-time All-Star, winning the most valuable player award three times. He was easy to underestimate in his physical appearance and speech, but in the long history of baseball, no one had his level of accomplishment as a player and a coach. On top of it all, he was liked by everyone: fans, teammates, coaches, even Ted Williams, the great Red Sox hitter who famously hated everyone. Ted Williams liked Yogi Berra, which might be the most astonishing fact of all.

Separating fact from fiction is often difficult and, as Yogi (allegedly) noted, “I never said most of the things I said.” I often feel the same way. But one thing Yogi said fits well with how I think about investing. Yogi noted, “you can observe a lot by watching.”

We are in the midst of heightened investor nervousness. This worry stems from a number of real concerns: a sudden slowdown in China’s growth, a tenuous recovery in the US that could be threatened by tighter monetary policy, growth in Europe and Japan that have slipped toward zero, EM currencies in freefall, the rise of Donald Trump and Bernie Sanders. It’s September and the Mets have a better record than the Yankees! All of this, understandably, is unnerving.

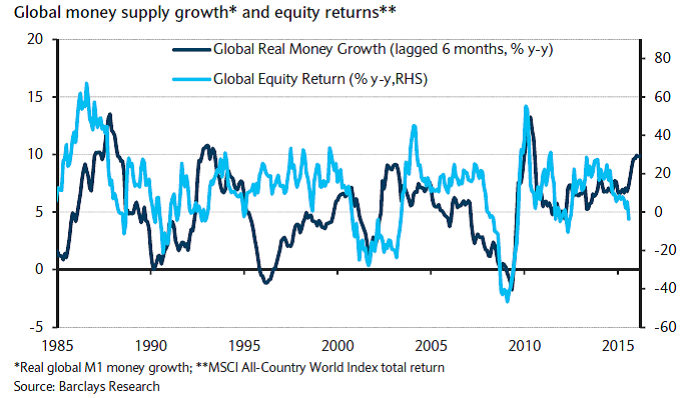

But the data I see are more comforting. Most importantly, global monetary policy is highly accommodative, especially in Europe, but more easing will likely come from Japan and China, and the Fed just postponed it’s expected tightening. With a lag, money growth leads equities (see graph).

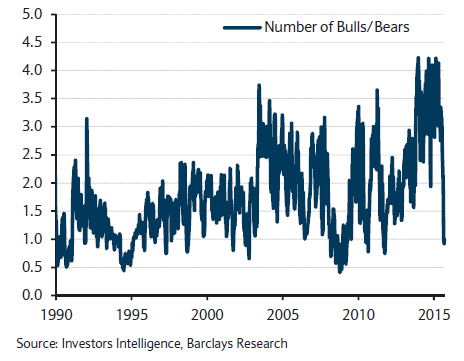

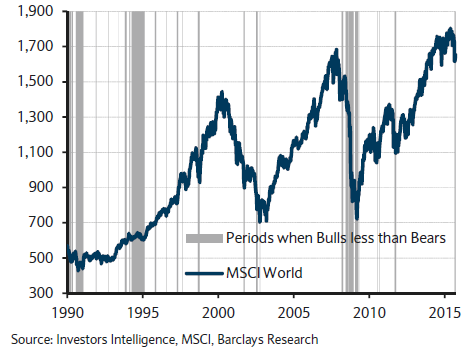

Also, sentiment is terrible (see first graph below), for the many real reasons listed above, but negative sentiment has always been one of my favorite contrary indicators. The vertical lines in the 2nd graph below line up with a bull/bear ratio less than one, almost always a mark of an equity bottom.

Valuations are right around historical averages, but investors are worried that record-high profits have peaked. Forward earnings estimates have turned down, but all of this comes from cuts in oil producers. Over the past year, earnings estimates of global oil producers have been slashed $148 billion, while earnings of oil beneficiaries have only been increased $9 billion. This has shaved 6 full percentage points off of global corporate earnings estimates. Yet over the past 4 years, oil consumption has declined from 5% of world GDP to just 2%, the lowest in 20 years, representing a $2 trillion transfer of wealth from oil producers to consumers.

There are many reasons investors have to worry, many of them valid. But I continue to see the risk of a recession in the US as extremely low. With a growing economy, low inflation and reasonable valuations, an implosion in equities just does not seem very likely.

Of course, I say this with a certain degree of caution. As one of Yogi’s managers, the great Casey Stengel, also among the most colorful and successful baseball managers of all time, warned, “never make predictions, especially about the future.”