Picking Up the Pace

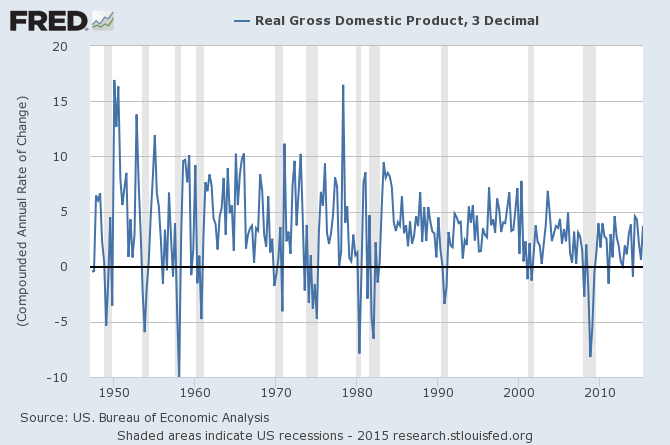

Lost amidst the market turmoil this week were a number of reports of a strengthening US economy. Consumer confidence soared last month, as did new home sales. Durable goods orders surprised with a 2% jump in July, and personal incomes rose, and are up 4.3% over the past twelve months. 2Q GDP was revised sharply higher, from a 2.3% annual growth rate to 3.7%. This pace is above the 3.2% quarterly average over the past 65 years (see Graph below).

All major components of GDP were revised higher, indicating broad strength in the economy, with business investment particularly strong. In contrast, the European economy crept just 0.4% higher last quarter, while Japan’s actually contracted by 1.6%. China grew at a 7% pace in the second quarter, or so they say.

While there is a lot to worry about in the world, that’s really always true. The risk of a recession in the US is very low, and I just don’t see a collapse in equity prices. Volatility, to be sure, but the US economy is growing and monetary remains accommodative. So we stay the course.