-

![Michael Rosen]()

-

Investment Insights are written by Angeles' CIO Michael Rosen

Michael has more than 30 years experience as an institutional portfolio manager, investment strategist, trader and academic.

HOT BIDDING

Published: 07-27-2015

The housing recovery, from its worst downturn since at least the 1930s, has been steady, but much less robust than most had expected. There are many explanations offered, from mean banks who have tightened lending standards, to over-indebted households who have no capacity to borrow, to a societal shift away from ownership to renting. There’s probably some truth in all of these. But housing is picking up steam, and one of the phenomenon of previous bubbles, bidding wars, may be coming back.

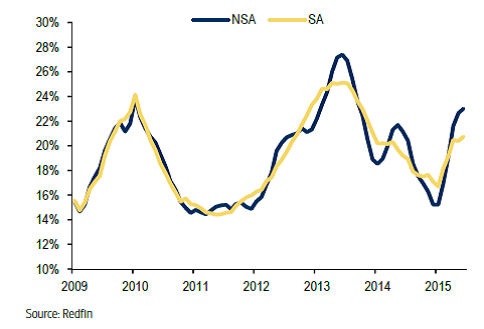

This first graph (courtesy Redfin) shows the percentage of homes nationally selling above their asking prices: 23% last month, up 2% from a year ago, although still below the 27.4% peak reached two years ago.

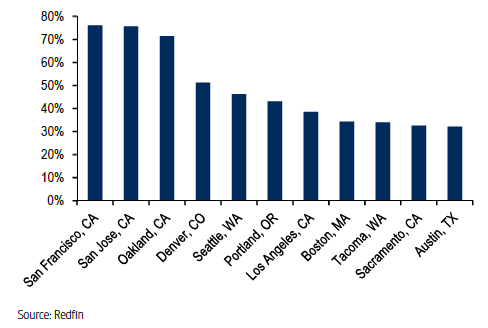

The hottest markets are in the West (see below). In the Bay Area, a staggering 75% of homes are selling above asking price!

There are other data supporting a pick-up in housing activity. Building permits and existing home sales are both at their highest levels in 8 years. I don’t see these as bubble levels because we are coming off a low base. So, for now, I take these data as signs of a strengthening housing market.