Erin Go Bragh!

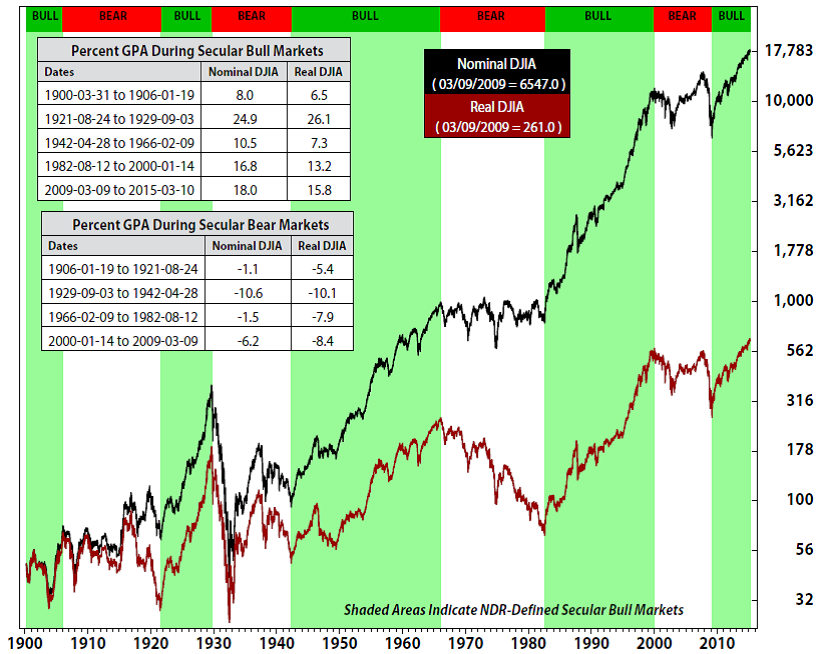

In honor of St. Patrick, I thought I’d share this (mostly) green chart with you, showing the DJIA over the past 115 years, delineated by bull and bear markets (courtesy of Ned Davis Research).

US stocks are at all-time highs in both nominal and real terms, and you can see we are in the midst of a secular bull market. My own two punts (or cents) is that valuations in US equities are a bit stretched, but not extreme, meaning a correction of 5% or 10% should be expected. But that this would devolve into a bear market seems unlikely to me.

It is well known that there are no snakes (the reptilian kind, I can’t vouch about the human version) in Ireland because St. Patrick banished them to the sea. Scientists tells us that post-glacial Ireland never had snakes, so there was nothing for St. Patrick to banish, but like most Irish tales, I prefer the story to the facts.

But as investors, it’s just the facts (ma’am). The secular bull market demands we remain fully committed to equities, but valuations suggest we should anticipate some turbulence. But we welcome any declines, which we will put to good use by rebalancing portfolios. So fear not the snakes lurking in the grass; they, too, will be banished again. Erin Go Bragh!